Insurance Details

The mandatory civil liability insurance policy for motor vehicles (RCA) is taken out in compliance with the provisions of Law no. 135/1996 and Norm no. 39/2016 on insurances and reinsurances in Romania, as further amended and supplemented, compulsorily, by all the motor vehicle holders, for a period ranging from 1 to 12 months, for the motor vehicle registered in Romania

The risks covered by the mandatory civil liability insurance policy for motor vehicles (RCA)

a) bodily injury or death, including for damages without a patrimonial nature;

b) material damages;

c) damages representing the consequence of the lack of use of the damaged vehicle;

d) legal charges incurred by the aggrieved person.

The indemnification limits, according to the applicable legislation, are:

a) for the material damages produced in one and the same accident, irrespective of the number of indemnified people, the indemnification limit is established at a level of EUR 1,000,000, RON equivalent, at the exchange rate of the foreign exchange market on the accident occurrence date, communicated by the National Bank of Romania;

b) for bodily injuries and deaths, including for damages without a patrimonial nature, incurred in one and the same accident, irrespective of the number of indemnified people, the indemnification limit is established at a level of EUR 5,000,000, RON equivalent, at the exchange rate of the foreign exchange market on the accident occurrence date, communicated by the National Bank of Romania;

c) for the material damages produced in one and the same accident, irrespective of the number of aggrieved people, the indemnification limit is established, for accidents occurred as of January 1st, 2017, at a level of EUR 1,220,000, RON equivalent, at the exchange rate of the foreign exchange market on the accident occurrence date, communicated by the National Bank of Romania;

d) for bodily injuries and deaths, including for damages without a patrimonial nature, incurred in one and the same accident, irrespective of the number of aggrieved people, the indemnification limit is established, for accidents occurred as of January 1st, 2017, at a level of EUR 6,070,000, RON equivalent, at the exchange rate of the foreign exchange market on the accident occurrence date, communicated by the National Bank of Romania.

Exclusions

The Insurer does not grant indemnification for:

1. the case where the owner, user or driver of the motor vehicle at fault does not have civil liability, if the accident was produced:

a) in a force majeure case;

b) due to the exclusive fault of the aggrieved person;

c) due to the exclusive fault of a third person, except for the damages produced to third parties, as a consequence of the opening of the vehicle doors, while driving or when the vehicle is stopped or parked, by the passengers thereof, without ensuring that the safety of the travel of the other participants in traffic is not endangered.

2. the damages produced to property belonging to the driver of the vehicle in charge of the accident occurrence, as well as those produced following the bodily injury or death thereof, irrespective of who requests these indemnifications;

3. the following situations:

a) the damages were produced to the property belonging to the individuals or legal entities, if they were caused by a vehicle insured by mandatory civil liability insurance for motor vehicles, owned or used by the same natural person or legal entity and which is driven by an agent of the same legal entity or by another person for whom the individual or the legal entity is liable;

b) the damaged property and the insured vehicle are part of the common patrimony of the spouses;

c) the damaged property is used by the owner of the insured vehicle having produced the damage;

4. the damages caused in the situations where evidence of the validity, on the accident date, of the mandatory civil liability insurance for motor vehicles (RCA) is not provided or the insurer of the mandatory civil liability insurance for motor vehicles (RCA) is not liable;

5. the part of the damage exceeding the indemnification limits established by the mandatory civil liability insurance policy for motor vehicles (RCA), produced in one and the same accident, irrespective of the number of aggrieved people and the number of people liable for the damage occurrence;

6. the fines of any kind and criminal expenses binding to the owner, user or driver of the insured vehicle, liable for the damage occurrence;

7. the expenses incurred within the criminal trial by the owner, user or driver of the insured vehicle, liable for the damage occurrence, even if the civil side was also settled during the criminal trial;

8. the amounts that the driver of the vehicle liable for the damage occurrence is bound to pay to the owner or user having entrusted the insured vehicle thereto, for the damaging or destruction of this vehicle;

9. the damages produced to the transported goods, if a contractual relation existed, on the accident occurrence date, between the owner or user of the vehicle having produced the accident or the liable car driver and the aggrieved people;

10. the damages produced to the people or property to be found in the vehicle having produced the accident, if the insurer can prove that the aggrieved people were aware of the fact that the respective vehicle was stolen;

11. the damages produced by the devices or installations mounted on the vehicles, when they are used as working machinery or installations;

12. the damages produced by accidents occurred during the loading and unloading operations, there representing risks of the professional activity;

13. the damages produced as a consequence of the transportation of dangerous products: radioactive, ionizing, inflammable, explosive, corrosive, combustible, having determined or aggravated the damage occurrence;

14. the damages produced by use of a vehicle during a terrorist attack or war, if the event is directly connected to the respective attack or war;

15. the claims as a consequence of the diminishment of the value of the property after the repair.

In the event the aggrieved person wrongfully contributed to the accident occurrence or damage extension, the one in charge shall be held liable only for the part of the damage imputable thereto – joint culpability. In such situations, the extension of the liability of each person shall be the one ascertained by any pieces of evidence.

The liability of the insurer of the mandatory civil liability insurance for motor vehicles (RCA) begins:

a) on the day following the one on which the validity of the previous insurance policy expires, for the insured fulfilling the obligation of taking out the insurance at the latest on the last day of validity thereof;

b) on the day following the one on which the insurance document was concluded, for the people who did not have a mandatory civil liability insurance for motor vehicles (RCA) valid upon the insurance take-out la;

c) from the release of the insurance document, but not earlier than the date when the provisory circulation permit or vehicle registration, for the sold vehicles, that are going to be registered become effective.

The liability of the insurer of the mandatory civil liability insurance for motor vehicles (RCA) ends at 12:00 a.m. on the last day of validity recorded in the mandatory civil liability insurance policy for motor vehicles (RCA) or prior to this date, upon the deregistration from the circulation records or on the date on which the insured submits to the insurer supporting documents on the transfer of the ownership over the insured vehicle.

The mandatory civil liability insurance policy for motor vehicles (RCA) can be cancelled /terminated exclusively in the following situations:

- upon the alienation of the motor vehicle, on condition of the presentation of the supporting documents (sale-purchase deed, deregistration certificate/copy of the vehicle registration document /registration certificate, mandatory civil liability insurance policy for motor vehicles (RCA) in the name of the new owner, etc.);

- in the event the motor vehicle is declared total damage.

In both situations, the difference between the paid insurance premium and the one calculated can be recovered as the difference between the insurance premium afferent to the period comprised between the starting date and the ending date of the liability of the insurer of the mandatory civil liability insurance for motor vehicles (RCA), by adding up the monthly premiums established in the premium rate of the insurer of the mandatory civil liability insurance for motor vehicles (RCA), corresponding to the full number of months comprised in the insurance validity period, only in the cases indemnifications for events produced over the insurance validity period were not paid or are not owed.

Bonus Malus

Bonus-Malus System

A new Bonus-Malus System according to the Norm of the Financial Supervisory Authority no. 39/2016 has been added since December 8th, 2016.

The "malus" points refer to the penalties granted to those having produced accidents, and "bonus" are the points received for good behaviour (years without damages).

There are 8 Bonus classes and 8 Malus class. A certain discount percentage or increase of the premium rate of the mandatory civil liability insurance for motor vehicles (RCA) corresponds to each class.

| MALUS | M8 | M7 | M6 | M5 | M4 | M3 | M2 | M1 | B0 | B1 | B2 | B3 | B4 | B5 | B6 | B7 | B8 | BONUS |

|

|

||||||||||||||||||

| COEFICIENT | 132% | 128% | 124% | 120% | 116% | 112% | 108% | 104% | 100% | 96% | 92% | 88% | 84% | 80% | 76% | 72% | 68% | COEFICIENT |

Manner of application of the bonus-malus system in reference to the number of damages

| MALUS | M8 | M7 | M6 | M5 | M4 | M3 | M2 | M1 | B0 | B1 | B2 | B3 | B4 | B5 | B6 | B7 | B8 | BONUS |

|

|

||||||||||||||||||

| 1 DAMAGE | M8 | M8 | M8 | M7 | M6 | M5 | M4 | M5 | M2 | M1 | B0 | B1 | B2 | B3 | B4 | B5 | B6 | 1 DAMAGE |

|

|

||||||||||||||||||

| 2+ DAMAGES | M8 | M8 | M8 | M8 | M8 | M7 | M8 | M6 | M4 | M3 | M2 | M1 | B0 | B1 | B2 | B3 | B4 | 2+ DAMAGES |

|

|

||||||||||||||||||

| Bodily injuries / Death | M8 | M8 | M8 | M8 | M8 | M8 | M8 | M8 | M8 | M8 | M8 | M3 | M2 | M1 | B0 | B1 | B2 | Bodily injuries / Death |

Green Card

The Green Card car insurance (the green part of the mandatory civil liability insurance for motor vehicles (RCA) is compulsory, but, unlike the Civil Liability Insurance for Motor Vehicles, covering the damages produced to third parties on the Romanian territory, it covers the damages produced to third parties abroad.

If the insured involved in an accident abroad produced damages to third parties, they are indemnified by the Green Card policy.

All the insurance companies provide coverage for the Green Card on the territory of the countries in the European Economic Area: Austria, Belgium, Bulgaria, Cyprus, the Czech Republic, Germany, Denmark, Spain, Estonia, France, Finland, UK, Greece, Hungary, Italy, Island, Ireland, Luxembourg, Lithuania, Malta, Norway, the Netherlands, Portugal, Poland, Romania, Sweden, Slovakia, Slovenia.

There are, however, countries that are covered only by some insurance companies. The following are part of this category: Switzerland, Albania, Andorra, Bosnia & Herzegovina, Belarus, Croatia, Israel, Iran, Morocco, Moldova, Macedonia, Russia, Serbia, Turkey, Ukraine.

In reference to this aspect, the insurance company providing coverage in the respective countries is chosen.

In the event the insured was indemnified following an accident produced by an insured vehicle, but registered abroad, you can refer to the Romanian Motor Insurers’Bureau for assistance.

in the event the one at fault for the damage occurrence is not identified or they do not hold a mandatory civil liability insurance for motor vehicles (RCA) valid on the accident occurrence date, we recommend you to refer to the Street Victim Protection Fund.

The Insured’s Guaranty Fund deals with the protection of the insured in case of insolvency of an insurer. The Fund makes payments of indemnifications /compensation resulted from the optional and mandatory insurance contracts, within the terms of the law, in case of bankruptcy of an insurer, in full observance of the guarantee ceiling stipulated by law, of RON 450,000 per insurance creditor of the bankrupt insurer.

What do I do in case of damage?

The purpose of the Civil Auto Liability policies is that of covering the damages produced to a third party following an automotive event. In this situation, all measures shall be taken in order to limit the occurrence of new damages.

If the accident results in bodily injuries to one or several people or if one of the vehicles transported dangerous substances, you are bound to call the single emergency telephone number 112. In this situation, leaving the place of the accident or alteration of the traces of the accident until the appearance of the police crew is forbidden. They shall establish the fault of the parties, shall fill in the inspection report for the damaged motor vehicle.

In the case of slight accident, having resulted only in material damages, on the Romanian territory, another event inspection form can be used in order to obtain the indemnifications via the Civil Auto Liability policy.

The procedure of use of the "amicable settlement" form stipulates the mutual agreement of the car drivers. This document requires, for the fill-in thereof, particular attention to the circumstances in which the accident occurred. Practically, bureaucracy and the presence of the police crew in order to ascertain the perpetrated deed are avoided by this procedure.

If the two parties fail to agree in order to establish the guilt, they will go to the Police Station within the action range whereof the event took place, within 48 hours. In this situation, the police agent shall establish the culpability, shall fill in the report and shall release the document authorizing the repairs. The party at fault shall hand over to the injured party a copy of the mandatory civil liability insurance for motor vehicles (RCA) policy or the latter shall get it from the Police Station.

If damages were produced to you by a car registered in another country, you need to refer to the Romanian Motor Insurers’ Bureau.

Documents necessary upon the presentation at the damage bureau of the insurance company of the person at fault for the car incident:

vehicle registration document;

identity card;

notarized power-of-attorney from the car owner;

copy of the civil liability insurance for motor vehicles (RCA) policy issued by the respective insurance company;

report released by the Police or amicable settlement form;

car registration certificate;

driving license;

Damage Call Center: 031 9660

Costin Lăzărescu, Damage Manager - 0746.14.10.40

I want an offer!

ASK FOR A CUSTOMIZED OFFER!!

I want to be contacted by a representative

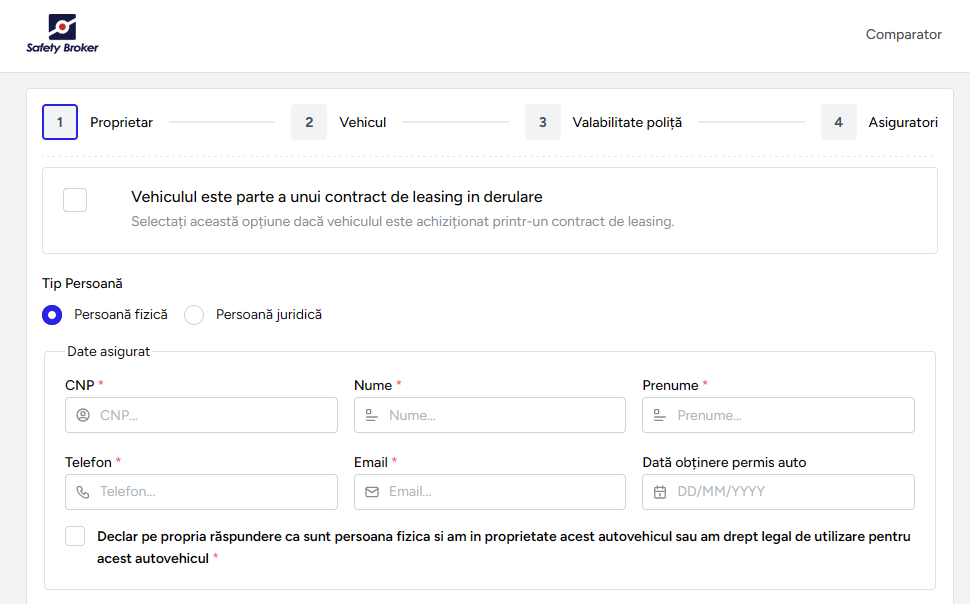

Calculator RCA - Safety Broker